Risk Attribution

1. Introduction

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next page

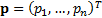

1.1 Traditionally, risk attribution (if the risk

model is characterised by a covariance matrix) proceeds as follows. We assume

that there are n different instruments in the universe in question. We

assume that the portfolio and benchmark weights can be represented by vectors  and

and  respectively. The

active positions are then

respectively. The

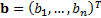

active positions are then  . If the risk model is

characterised in the parsimonious manner involving a factor covariance matrix,

. If the risk model is

characterised in the parsimonious manner involving a factor covariance matrix,  , and a sparce

idiosyncratic matrix,

, and a sparce

idiosyncratic matrix,  , e.g. as described in

Kemp (2009), then

, e.g. as described in

Kemp (2009), then  . The matrix describing

the covariance structure between factors, i.e.

. The matrix describing

the covariance structure between factors, i.e.  corresponds to a projection

of an n dimensional space onto a smaller m dimensional space.

corresponds to a projection

of an n dimensional space onto a smaller m dimensional space.

1.2 Factors might be further grouped into one of,

say,  different factor types,

using what we might call a factor classification,

different factor types,

using what we might call a factor classification,

, i.e. a

, i.e. a  projection

matrix that has the property that each underlying factor is apportioned across

one or more ‘super’ factor types. By apportioned we mean that if

projection

matrix that has the property that each underlying factor is apportioned across

one or more ‘super’ factor types. By apportioned we mean that if  corresponds to the

exposure that the j’th factor has to the k’th factor type then

the sum of these exposures for any given factor is unity, i.e.

corresponds to the

exposure that the j’th factor has to the k’th factor type then

the sum of these exposures for any given factor is unity, i.e.  .

.

1.3 Usually such a factor classification (at least

in equity-land) would involve unit disjoint elements, i.e. each factor would be

associated with a single ‘super’ factor type. For example, equity sector

classification structures are usually hierarchical, so each industry subgroup

is part of a (single) overall market sector. More generally, factors might be

apportioned across more than one factor type. The aggregate (relative) exposure

to the different factor types is then, in matrix algebra terms, equal to  .

.

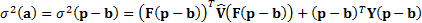

1.4 To decompose (or ‘attribute’) the tracking

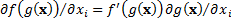

error into its main contributors it is usual to decompose the tracking error,  , in the manner

described in Kemp

(2005), Kemp

(2009) or Heywood,

Marsland and Morrison (2003), i.e. in line with partial differentials

(scaled if necessary by a uniform factor so that the total adds up to the total

tracking error). For example, if the aim is to identify the risk contribution

coming from each individual security then we might calculate the marginal

contribution to tracking error,

, in the manner

described in Kemp

(2005), Kemp

(2009) or Heywood,

Marsland and Morrison (2003), i.e. in line with partial differentials

(scaled if necessary by a uniform factor so that the total adds up to the total

tracking error). For example, if the aim is to identify the risk contribution

coming from each individual security then we might calculate the marginal

contribution to tracking error,

, and the contribution

to tracking error,

, and the contribution

to tracking error,  , from the i’th

instrument as follows:

, from the i’th

instrument as follows:

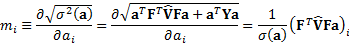

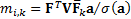

1.5 This has  , so the sum of the

individual contributions assigned to each instrument is the total tracking

error of the portfolio. Simetimes writers instead focus on decomposing the

variance rather than the standard deviation. However the answers are the same

up to a scaling factor. This is to be expected since for any two functions,

, so the sum of the

individual contributions assigned to each instrument is the total tracking

error of the portfolio. Simetimes writers instead focus on decomposing the

variance rather than the standard deviation. However the answers are the same

up to a scaling factor. This is to be expected since for any two functions,  and

and  with

first differentials

with

first differentials  and

and  we have

we have  , i.e. the vector of

partial differentials is the same, up to a scaling factor for all functions of

same underlying risk measure. Variance and standard deviation in this context

relate to the ‘same’ underlying risk measure, since variance is the square of

standard deviation.

, i.e. the vector of

partial differentials is the same, up to a scaling factor for all functions of

same underlying risk measure. Variance and standard deviation in this context

relate to the ‘same’ underlying risk measure, since variance is the square of

standard deviation.

1.6 We can group the  in whatever manner we

like, as long as each relative position is assigned to a unique grouping or if

it is split across several groupings then in aggregate a unit contribution

arises from it.

in whatever manner we

like, as long as each relative position is assigned to a unique grouping or if

it is split across several groupings then in aggregate a unit contribution

arises from it.

1.7 For example, suppose that we have a

classification described by the  matrix

matrix  with elements

with elements  being the contribution

that the i’th instrument makes to the q’th classification. As it

is a classification it needs to satisfy

being the contribution

that the i’th instrument makes to the q’th classification. As it

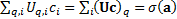

is a classification it needs to satisfy  so

so  , i.e. grouping in this

manner is equivalent to calculating

, i.e. grouping in this

manner is equivalent to calculating  where

where  .

.

1.8 A special case of such a classification would

be to calculate the contribution to risk from a given issuer (rather than a

given instrument), e.g. for a bond portfolio, where  would be 1 if issue

would be 1 if issue  is

issued by issuer

is

issued by issuer  and 0 otherwise.

and 0 otherwise.

1.9 The above approach calculates a single overall

contribution to tracking error for each individual instrument (and then if

necessary groups them). For bond risk analysis (and also in some instances for

equity risk analysis) it may be more illuminating to subdivide these instrument

specific contributions into several different sub-elements, each one relating

to a given factor type. These factor types might be, say, currency, interest

rate (duration), credit, sector, other factors and idiosyncratic.

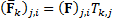

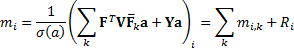

1.10 To do this we need to subdivide  into several different

elements, which cumulatively add up to

into several different

elements, which cumulatively add up to  , each relating to a

different factor type, i.e. we define, say,

, each relating to a

different factor type, i.e. we define, say,  each of which are

each of which are  matrices,

which have the property that the

matrices,

which have the property that the  ’th element of

’th element of  is calculated as

is calculated as  for a given factor

classification

for a given factor

classification  . The sum of the

. The sum of the  for all

for all  is

then

is

then  . We can then decompose

the marginal contributions to tracking error into the following, where

. We can then decompose

the marginal contributions to tracking error into the following, where  and

and  :

:

NAVIGATION LINKS

Contents | Prev | Next