Risk Attribution

2. Implied Alphas

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next page

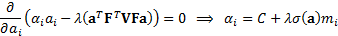

2.1 An individual security’s marginal contribution

to risk is closely allied to its implied alpha,

, i.e. the expected

outperformance (or underperformance) you need to expect from the instrument if

the portfolio is to be ‘efficient’ in the sense of optimally trading off risk

against return. For the portfolio to be efficient we need to have, for some

portfolio risk aversion parameter,

, i.e. the expected

outperformance (or underperformance) you need to expect from the instrument if

the portfolio is to be ‘efficient’ in the sense of optimally trading off risk

against return. For the portfolio to be efficient we need to have, for some

portfolio risk aversion parameter,  , all of the following

, all of the following  equations

simultaneously to be true (in a mean-variance world):

equations

simultaneously to be true (in a mean-variance world):

2.2 Here  is an arbitrary

constant that might be chosen so that the weighted average implied alpha of the

benchmark is zero, since the implied alpha of a given portfolio or instrument

is then more directly related to the expected excess alpha that such a

portfolio might deliver versus the benchmark.

is an arbitrary

constant that might be chosen so that the weighted average implied alpha of the

benchmark is zero, since the implied alpha of a given portfolio or instrument

is then more directly related to the expected excess alpha that such a

portfolio might deliver versus the benchmark.

NAVIGATION LINKS

Contents | Prev | Next