Risk Attribution

3. Beta-adjusted attribution

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next page

3.3 Beta

is benchmark specific, i.e. a stock with a given beta against one market index

may have a different beta against a different market index. The terminology

‘beta’ arises because in effect we are ascribing a security’s (or an entire

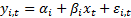

portfolio’s) return in a manner akin to a regression analysis in which  where

where  is the return on the i’th

security in the t’th time period,

is the return on the i’th

security in the t’th time period,  is the return on the

market index in the t’th time period. Conventionally the intercept of

this regression is typically referred to as the ‘alpha’ and the slope of this

regression as the ‘beta’.

is the return on the

market index in the t’th time period. Conventionally the intercept of

this regression is typically referred to as the ‘alpha’ and the slope of this

regression as the ‘beta’.

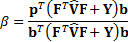

3.4 From

an ex-ante risk perspective, the portfolio beta can

be calculated as:

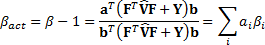

3.5 The active portfolio beta is

then:

where we have decomposed the overall active beta into

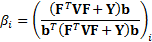

contributions from each individual (active) position,  , where

, where

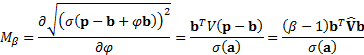

3.6 The marginal contribution to tracking error

from a portfolio’s beta is then

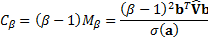

3.7 The portfolio’s overall active contribution to

tracking error from its beta is therefore:

3.8 We can apportion the marginal contribution to

tracking error from the portfolio beta across individual securities using, say,

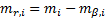

and thus identify the

‘residual’ (non-beta) element of each security’s marginal contribution to

tracking error as, say,

and thus identify the

‘residual’ (non-beta) element of each security’s marginal contribution to

tracking error as, say,  . The active ‘residual’

(non-beta) contribution to tracking error by security would then be

. The active ‘residual’

(non-beta) contribution to tracking error by security would then be  .

.

NAVIGATION LINKS

Contents | Prev | Next