Quantitative Return Forecasting

3. The spectrum and z-transform of

a time series

[this page | pdf | references | back links]

Return to Abstract and

Contents

Next page

3.1 An equivalent way of analysing a time series

is via its spectrum since we can transform a time series into a

frequency spectrum (and vice versa) using Fourier transforms. Take for example

another sort of prototypical time series model, i.e. the moving average or

MA model. This assumes that the output depends purely on an input series

(without autoregressive components), i.e.:

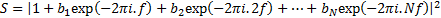

3.2 There are three equivalent characterisations

of a  model:

model:

(a)

In the time domain - i.e. directly via the  .

.

(b)

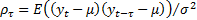

In the form of autocorrelations, i.e.  (where

(where

means

the expected value of

means

the expected value of  and

and  and

and

.

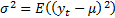

If the input to the system is a stochastic process with input values at

different times being uncorrelated (i.e.

.

If the input to the system is a stochastic process with input values at

different times being uncorrelated (i.e.  for

for

)

then the autocorrelation coefficients become:

)

then the autocorrelation coefficients become:

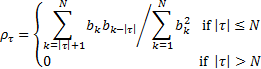

(c)

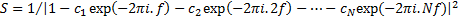

In the frequency domain. If the input to a  model is

an impulse then the spectrum of the output (i.e. the result of applying the

discrete Fourier transform to the time series) is given by:

model is

an impulse then the spectrum of the output (i.e. the result of applying the

discrete Fourier transform to the time series) is given by:

3.3 It is possible to show that an AR model

of the form described earlier has a power spectrum of the following form:  .

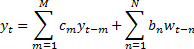

The obvious next step in complexity is to have both AR and MA components in the

same model, e.g. an

.

The obvious next step in complexity is to have both AR and MA components in the

same model, e.g. an  model,

of the following form:

model,

of the following form:

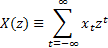

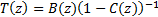

3.4 The output of an  model is

most easily understood in terms of the z-transform, which generalises

the discrete Fourier transform to the complex plane, i.e.:

model is

most easily understood in terms of the z-transform, which generalises

the discrete Fourier transform to the complex plane, i.e.:

3.5 On the unit circle in the complex plane the z-transform

reduces to the discrete Fourier transform. Off the unit circle, it measures the

rate of divergence or convergence of a series. Convolution of two series in the

time domain corresponds to the multiplication of their z-transforms.

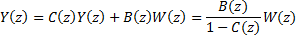

Therefore the z-transform of the output of an  model

is:

model

is:

3.6 This has the form of an input z-transform

multiplied

by a transfer function

multiplied

by a transfer function  unrelated

to the input. The transfer function is zero at the zeros of the

unrelated

to the input. The transfer function is zero at the zeros of the  term,

i.e. where

term,

i.e. where  ,

and diverges to infinity, i.e. has poles (in a complex number sense), where

,

and diverges to infinity, i.e. has poles (in a complex number sense), where  ,

unless these are cancelled by zeros in the numerator. The number of poles and

zeros in this equation determines the number of degrees of freedom in

the model. Since only a ratio appears there is no unique

,

unless these are cancelled by zeros in the numerator. The number of poles and

zeros in this equation determines the number of degrees of freedom in

the model. Since only a ratio appears there is no unique  model

for any given system. In extreme cases, a finite-order

model

for any given system. In extreme cases, a finite-order  model

can always be expressed by an infinite-order

model

can always be expressed by an infinite-order  model,

and vice versa.

model,

and vice versa.

3.7 There is no fundamental reason to expect an

arbitrary model to be able to be described in an  form.

However, if we believe that a system is linear in nature then it is reasonable

to attempt to approximate its true transfer function by a ratio of polynomials,

i.e. as an

form.

However, if we believe that a system is linear in nature then it is reasonable

to attempt to approximate its true transfer function by a ratio of polynomials,

i.e. as an  model. This is a problem in

function approximation. It can be shown that a suitable sequence of ratios of

polynomials (called Padé approximants) converges faster than a power series

for an arbitrary function. But this still leaves unresolved the question of

what the order of the model should be, i.e. what values of

model. This is a problem in

function approximation. It can be shown that a suitable sequence of ratios of

polynomials (called Padé approximants) converges faster than a power series

for an arbitrary function. But this still leaves unresolved the question of

what the order of the model should be, i.e. what values of  and

and  to

adopt. This is in part linked to how best to approximate the z-transform.

There are several heuristic algorithms for finding the ‘right’ order, for

example the Akaike Information Criterion, see e.g. Billah,

Hyndman and Koehler (2003). These heuristic approaches usually rely very

heavily on the model being linear and can also be sensitive to the assumptions

adopted for the error terms.

to

adopt. This is in part linked to how best to approximate the z-transform.

There are several heuristic algorithms for finding the ‘right’ order, for

example the Akaike Information Criterion, see e.g. Billah,

Hyndman and Koehler (2003). These heuristic approaches usually rely very

heavily on the model being linear and can also be sensitive to the assumptions

adopted for the error terms.

3.8 This point is also related to the distinction

between in-sample and out-of-sample analysis. By in-sample we

mean an analysis carried out on a particular data set not worrying about the

fact that later observations would not have been know about at earlier times in

the analysis. If, as will always be the case in practice, the data series is

finite then incorporating sufficient parameters in the model will always enable

us to fit the data exactly (in much the same way that a sufficiently high order

polynomial can always be made to fit exactly a fixed number of points on a

curve).

3.9 What normally happens is that the researcher

will choose one period of time to estimate the parameters characterising the

model and will then test the model out-of-sample using data for a

subsequent (but still historic) time period. Sometimes the parameters will be

fixed at the end of the in-sample period.

3.10 Alternatively, if we have some a priori

knowledge about the nature of the linear relationship then our best estimate at

any point in time will be updated as more knowledge becomes available in a

Bayesian fashion. Updating estimates of the linear parameters in this manner is

usually called applying a Kalman filter to the process, a technique that

is also used in general insurance claims reserving.

3.11 In derivative pricing there is a similar need

to avoid look-forward bias, and this is achieved via the use of so called adapted

series, i.e. random series where you do not know what future impact the

randomness being assumed will have until you reach the relevant point in time

when the randomness arises.

3.12 However, it is worth bearing in mind that even

rigorous policing of in-sample and out-of-sample analysis does not avoid an

implicit element of ‘look-forward-ness’ when carrying out back tests of how a

particular quantitative return forecasting might perform in the future. This is

because the forecasters can be thought of as having a range of possible models

from which they might choose. They are unlikely to present results where

out-of-sample behaviour is not as desired. Given a sufficiently large number of

possible model types, it is always be possible to find one consistent with an

in-sample analysis that also looks good in a subsequent out-of-sample analysis.

By the time we do the analysis we actually know what happened in both periods.

NAVIGATION LINKS

Contents | Prev | Next