Quantitative Return Forecasting

2. Traditional time series analysis

[this page | pdf | references | back links]

Return to Abstract and

Contents

Next page

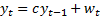

2.1 Consider first a situation where we only have

one time series where we are attempting to forecast future values from observed

past values. For example, the time series followed by a given variable might be

governed by the following relationship, where the value at time t of the

variable is denoted by  where

where

is

constant.

is

constant.

2.2 This is a linear first order difference

equation. A difference equation is an expression relating a variable

to

its previous values. The above equation is first order because only the

first lag (

to

its previous values. The above equation is first order because only the

first lag ( )

appears on the right hand side of the equation. It is linear because it

expresses

)

appears on the right hand side of the equation. It is linear because it

expresses  as

a linear function of

as

a linear function of  and

the innovations

and

the innovations  .

.

are

often treated as random variables, but we do not always need to do this.

are

often treated as random variables, but we do not always need to do this.

2.3 Such a model of the world is also an autoregressive

model, with a unit time lag and is therefore typically referred to as an  model.

It is also time stationary, since

model.

It is also time stationary, since  is constant. Nearly all

linear time series analysis assumes time invariance. We could however introduce

secular changes by assuming one of the variables on which the time series is

based is a dummy variable linked to time. An example commonly referred to in

the quantitative investment literature is a dummy variable set equal to 1 in

January but 0 otherwise, to identify whether there is any ‘January’ effect.

is constant. Nearly all

linear time series analysis assumes time invariance. We could however introduce

secular changes by assuming one of the variables on which the time series is

based is a dummy variable linked to time. An example commonly referred to in

the quantitative investment literature is a dummy variable set equal to 1 in

January but 0 otherwise, to identify whether there is any ‘January’ effect.

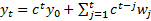

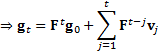

2.4 If we know the value  at

at

then we find using recursive

substitution that

then we find using recursive

substitution that  .

We can also determine the effect of each individual

.

We can also determine the effect of each individual  on, say,

on, say,  ,

the value of

,

the value of  that is

that is  time

periods further into the future value than

time

periods further into the future value than  .

This is sometimes called the dynamic multiplier

.

This is sometimes called the dynamic multiplier  .

If

.

If  then

such a system is stable, in the sense that the consequences of a given

change in

then

such a system is stable, in the sense that the consequences of a given

change in  will

eventually die out. It is unstable if

will

eventually die out. It is unstable if  .

An interesting possibility is the borderline case where

.

An interesting possibility is the borderline case where  , when

the output variable

, when

the output variable  is

the sum of its initial starting value and historical inputs.

is

the sum of its initial starting value and historical inputs.

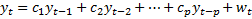

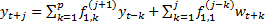

2.5 We can generalise the above dynamic system to

be a linear p’th order difference equation by making it depend on the

first  lags along with the current

value of the innovation (input value)

lags along with the current

value of the innovation (input value)  ,

i.e.

,

i.e.  .

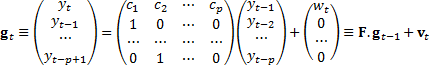

This can be rewritten in vector/matrix form as a first order difference

equation, but relating to a vector, if we define the vector as follows:

.

This can be rewritten in vector/matrix form as a first order difference

equation, but relating to a vector, if we define the vector as follows:

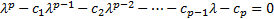

2.6 These sorts of dynamic systems have richer

structures than simple scalar difference equations. For a p’th order

equation we have:  (if

(if

is

the element in the i’th row and k’th column of

is

the element in the i’th row and k’th column of  ).

To analyse the characteristics of such a system in more detail, we first need

to identify the eigenvalues of

).

To analyse the characteristics of such a system in more detail, we first need

to identify the eigenvalues of  .

These are the values of

.

These are the values of  for which

for which  where

where

is

the identity matrix. They are the roots to the following equation:

is

the identity matrix. They are the roots to the following equation:

2.7 A p’th order equation such as this

always has p roots, but some of these may be complex numbers rather than

real ones, even if (as would be the case in practice for investment time

series) all the  are

real numbers. Complex roots correspond to cyclical (sinusoidal) behaviour. We

can therefore have combinations of exponential decay, exponential growth and

sinusoidal (perhaps damped or inflating) behaviour. For such a system to be

stable we require all the eigenvalues

are

real numbers. Complex roots correspond to cyclical (sinusoidal) behaviour. We

can therefore have combinations of exponential decay, exponential growth and

sinusoidal (perhaps damped or inflating) behaviour. For such a system to be

stable we require all the eigenvalues  to

satisfy

to

satisfy  ,

i.e. for their absolute values all to be less than unity.

,

i.e. for their absolute values all to be less than unity.

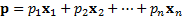

2.8 Eigenvalues are closely associated with principal

components analysis. All non-negative definite symmetric  matrices,

matrices,

,

will have

,

will have  non-negative eigenvalues

non-negative eigenvalues  and

associated eigenvectors

and

associated eigenvectors  (the

eigenvectors can sometimes be degenerate) that satisfy

(the

eigenvectors can sometimes be degenerate) that satisfy  .

The eigenvalues can be the same in which case the eigenvectors can be

degenerate. The eigenvectors are orthogonal (or can be chosen to be orthogonal

if they are degenerate), so that any n-vector

.

The eigenvalues can be the same in which case the eigenvectors can be

degenerate. The eigenvectors are orthogonal (or can be chosen to be orthogonal

if they are degenerate), so that any n-vector  can

be written as

can

be written as  .

.

2.9 The principal components are the eigenvectors

of the relevant covariance matrix corresponding to the largest eigenvalues,

since they explain the greatest amount of variance when averaged over all

possible positions. This is because  .

There is no fundamental reason why all stocks should be given equal weight in

this averaging process. Different weighting schemas result in different vectors

being deemed ‘principal’.

.

There is no fundamental reason why all stocks should be given equal weight in

this averaging process. Different weighting schemas result in different vectors

being deemed ‘principal’.

NAVIGATION LINKS

Contents | Prev | Next