Quantitative Return Forecasting

1. Introduction

[this page | pdf | references | back links]

Return to Abstract and

Contents

Next page

1.1 Many different techniques exist for trying to

predict or forecast the future movements of investment markets.

These range from purely judgemental to purely quantitative approaches and from

ones that concentrate on individual stocks to ones that are applied to sectors

or entire markets. In this set of pages on the Nematrian website we cover some

of the more quantitative tools that have been devised for this purpose. Many

very clever people have spent a lot of time devising quantitative ways of

forecasting future investment returns, so in these pages cover only some of the

many tools and techniques that might be used in practice.

1.2 Quantitative return forecasting can be

thought of as a special type of time series analysis. Hence many of the time

series analysis tools that are used in other contexts may also be applied to

quantitative investment analysis. Time series analysis can in turn be split

into two main types, both of which are typically analysed in a mathematical

context using regression techniques. These are:

(a) Analysis of the interdependence of two or

more variables measured at the same time, e.g. whether high inflation is

associated with high asset returns. The assumption here is that there is some

other exogenous way in which we can form an opinion on, say, how inflation will

move in the future, and we then use this together exogenous view, together with

an understanding of the interdependency of inflation and the asset return we

want to forecast or predict to work out the most appropriate investment stance

to adopt. The tools used are conceptually similar to those used for risk

measurement, except that with risk measurement we are typically seeking to

understand the spread of the distribution rather than its mean drift.

(b) Analysis of the interdependence of one or

more variables measured at different times, usually with some intuitive

justification proposed for the supposed interdependence being claimed from the

analysis. Such links (if they can be found and if they persist) can be used

directly to identify profitable investment strategies (as long as the excess

returns available from their use are not swamped by transactions costs).

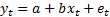

1.3 A simple example of a problem of the type

described in 1.2(a) might involve postulating that there was some a linear

relationship involving two time series,  and

and

(for

(for

,

where

,

where  is a suitable time index)

of the form

is a suitable time index)

of the form  where

the

where

the  are

random errors each with mean zero, and

are

random errors each with mean zero, and  and

and

are

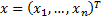

unknown constants. The same relationship can be written in vector form as

are

unknown constants. The same relationship can be written in vector form as  where

where  is

a vector of

is

a vector of  elements corresponding to

each element of the time series etc. In such a problem the

elements corresponding to

each element of the time series etc. In such a problem the  are

called the dependent variables and the

are

called the dependent variables and the  the

independent variables, as in the postulated relationship the

the

independent variables, as in the postulated relationship the  depend

on the

depend

on the  not

vice-versa.

not

vice-versa.

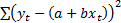

Such a

problem is most commonly solved by use of regression techniques, as explained

in many statistics textbooks. If the  are

independent identically distributed normal random variables with the same

variance (and same zero mean) then the maximum likelihood estimators of

are

independent identically distributed normal random variables with the same

variance (and same zero mean) then the maximum likelihood estimators of  and

and  are are

the values that minimise the sum of the squared forecast error, i.e.

are are

the values that minimise the sum of the squared forecast error, i.e.  .

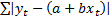

These are also known as their least squares estimators. More generally,

we might adopt other ways of estimating these variables including minimising,

say, the mean absolute deviation, which involves minimising

.

These are also known as their least squares estimators. More generally,

we might adopt other ways of estimating these variables including minimising,

say, the mean absolute deviation, which involves minimising  .

.

1.4 To convert this simple example into one of

the sort described in 1.2(b) we might incorporate a one-period time lag in the

above relationship, i.e. we would assume that stocks, markets and/or factors

driving them exhibit autoregression.

1.5 Typically, the mathematical framework

involved can most easily be explained using vectors, see below. Mathematically

we assume that there is some equation governing the behaviour of the system  .

The

.

The  might

now in general be vector quantities rather than scalar quantities, some of

whose elements might be unobserved state variables. However, the

simplest examples have a single (observed) series in which later terms depend

on former ones.

might

now in general be vector quantities rather than scalar quantities, some of

whose elements might be unobserved state variables. However, the

simplest examples have a single (observed) series in which later terms depend

on former ones.

1.6 Traditional time series analysis generally

assumes, at that  exhibits time

stationarity (meaning it has the same functional form for each

exhibits time

stationarity (meaning it has the same functional form for each  ). More

advanced variants might include regime shifts or the like, in which the model

of the world as characterised by

). More

advanced variants might include regime shifts or the like, in which the model

of the world as characterised by  can vary in some well

defined manner.

can vary in some well

defined manner.

1.7 We shall see later that time stationary

models can only describe a relatively small number of possible market dynamics

(in effect just regular cyclicality and purely exponential growth or

decay). This is probably why traditional linear time stationary regression

techniques seem to be rather less effective than one might hope at directly

identifying profitable investment strategies.

1.8 Investment markets do show cyclical

behaviour, but the frequencies of the cycles are often far from regular. It is

easy to postulate variables that ought to influence markets, but much more

difficult to identify ones that seem to do so consistently whilst at the same

time offering significant predictive power. Relationships that work well over

some time periods often seem to work less well over others.

1.9 Perhaps this is not too surprising. If

successful forecasting techniques were easy to find then presumably this would

already be well known and market prices would have already reacted, reducing or

eliminating the potential of such forecasting techniques to add value in the

future. In this field, as in other aspects of active investment management, it

is necessary to stay one step ahead of others!

NAVIGATION LINKS

Contents | Prev | Next