Marginal Value-at-Risk (Marginal VaR)

[this page | pdf | back links]

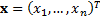

Suppose we have a set of  risk

factors which we can characterise by an

risk

factors which we can characterise by an  -dimensional

vector

-dimensional

vector  .

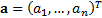

Suppose that the (active) exposures we have to these factors are characterised

by another

.

Suppose that the (active) exposures we have to these factors are characterised

by another  -dimensional vector,

-dimensional vector,  .

Then the aggregate exposure is

.

Then the aggregate exposure is  .

.

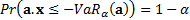

The Value-at-Risk of the portfolio of exposures  at

confidence level

at

confidence level  ,

,  ,

is usually defined to be the value such that

,

is usually defined to be the value such that  .

.

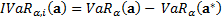

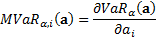

The Marginal Value-at-Risk,  ,

is the sensitivity of

,

is the sensitivity of  to

a small change in

to

a small change in  ’th exposure. It is therefore:

’th exposure. It is therefore:

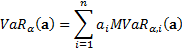

Because Value-at-Risk is (first-order) homogeneous (for a

continuous probability distribution) it satisfies the Euler capital allocation

principle and hence:

If the risk factors are multivariate normally distributed

then  can

be expressed using a relatively simple formula, see here.

can

be expressed using a relatively simple formula, see here.

The Marginal Value-at-Risk is sometimes called the

incremental value at risk (perhaps because a leading software vendor uses the

latter terminology). More usually incremental value at risk is defined as

follows, where  is

the same as

is

the same as  except

that it has 0 for its

except

that it has 0 for its  ’th entry.

’th entry.