Coherent Risk Measures

[this page | pdf | references | back links]

A risk measure,  is

defined by Artzner et al. (1999) to be coherent if it satisfies the following 4

axioms:

is

defined by Artzner et al. (1999) to be coherent if it satisfies the following 4

axioms:

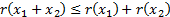

(a) Subadditivity:

for any pair of loss variables,  and

and

(b) Monotonicity:

if, for all states of the world,  then

then

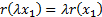

(c) Homogeneity:

for any constant  and random loss variable

and random loss variable

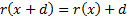

(d) Translational

invariance: for any constant  and random loss variable

x

and random loss variable

x

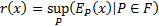

Artzner et

al. (1999) also showed that a risk measure is coherent if and only if there

is a family,  , of probability measures,

, of probability measures,

,

such that:

,

such that:

Sometimes the easiest way of proving that a risk measure is

coherent is to prove each of the four axioms are satisfied, at other times it

is easiest to show that it may be expressed in this supremum form.

For example TVaR can be shown to

be coherent by defining a set of probability measures that place equal

probability on  realisations where

realisations where  is the

smallest integer such that

is the

smallest integer such that  .

TVaR is then the maximum expected value of losses over this family of

distributions.

.

TVaR is then the maximum expected value of losses over this family of

distributions.

In contrast, VaR is coherent only for a

limited class of distributions, including multi-variate Normal (i.e. Gaussian)

distributions (for proof see here)

and more generally for elliptical

distributions.