Value-at-Risk

[this page | pdf | references | back links]

The Value-at-Risk, VaR, of a portfolio  is

the outcome (loss),

is

the outcome (loss),  , that will be exceeded on a

fraction

, that will be exceeded on a

fraction  of occasions. It requires a

time-scale (

of occasions. It requires a

time-scale ( ) as well as a confidence level

) as well as a confidence level  .

.

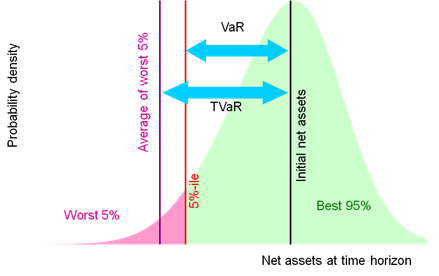

Where the support of the

distribution is continuous, the Value-at-Risk with confidence level  is:

is:

If the distribution is unbounded below then this means that

if the probability density function of the distribution is  we

have:

we

have:

If the lower bound is finite, e.g.  then the

definition would replace

then the

definition would replace  with

with  .

.

Note: sometimes  and

and  are

interchanged or losses are deemed positive rather than negative etc.

are

interchanged or losses are deemed positive rather than negative etc.

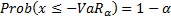

Visually the difference between VaR and Tail VaR (TVaR) may be

seen in either of the following charts:

VaR is not (in general) a coherent risk

measure, whilst TVaR is. VaR is arguably more shareholder focused and TVaR more

regulator/customer focused, see VaR versus TVaR mindsets.

If several different risk exposures are contributing to the

overall VaR then it often becomes important to identify the contribution each

is making to the total. This can be done using marginal Value-at-Risk.