Stable Distributions

1. Introduction

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next

page

1.1 Stable distributions are a class of probability

distributions that have interesting theoretical and practical properties that

make them potentially useful for modelling financial data. In a sense that we

will explore further below, they generalise the Normal distribution. They also

allow fat tails and skewness, characteristics that are also frequently observed

in financial data. Traditionally they have been perceived to be subject to the

practical disadvantage that they have infinite variances (apart from the

special case of the Normal distribution) and thus are not particularly easy to

manipulate mathematically. However, more recently, mathematical tools and

programs have been developed that simplify such manipulations.

1.2 Whether stable distributions are actually good

at modelling financial data is not something that we explore in depth in these

pages. Longuin

(1993), when analysing the distribution of U.S. equity returns, concluded

that their distribution was not sufficiently fat-tailed to be adequately

modelled by Levy stable distributions, even if it was fatter tailed than

implied by the normal distribution. Moreover, implicit within the theoretical

justification for (non-Normal) stable distributions in such a context is an

assumption that aggregate returns arise from the combined impact of a large

number of smaller independent innovations, so that a generalisation of the

Central Limit Theorem applies, see Section 4.

Fat-tailed behaviour in the distribution of aggregate returns in line with

stable laws can then be expected to arise if it is assumed that each of these

smaller innovations is also (suitably) fat-tailed. The challenge is that this

is not necessarily how fat tails arise in aggregate return data. Fat tails may

instead arise partly or wholly due to distributional mixtures, e.g. regime

shifts or time-varying volatility, or from one-off (systemic) ‘shocks’ that

cannot be conceptually decomposed in to lots of smaller independent elements,

see e.g. Kemp

(2009). The latter might include the impact of an aggregate loss of risk

appetite (and feedback effects that might then arise because of changed

perceptions amongst market participants regarding the views of others).

1.3 The implicit assumption underlying stable

distributions referred to in the previous paragraph is revealed by their

defining characteristic, and the reason for the term stable, which is

that they retain their shape (suitably scaled and shifted) under addition. The

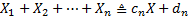

definition of a stable distribution is that if  are

independent, identically distributed random variables coming from such a distribution,

then for every

are

independent, identically distributed random variables coming from such a distribution,

then for every  we have the following

relationship for some constants

we have the following

relationship for some constants  and

and

:

:

Here  means equality in

distributional form, i.e. the left and right hand sides have the same

probability distribution. The distribution is called strictly stable if

means equality in

distributional form, i.e. the left and right hand sides have the same

probability distribution. The distribution is called strictly stable if  for

all

for

all  . Some authors use the

term sum stable to differentiate from other types of stability that

might apply.

. Some authors use the

term sum stable to differentiate from other types of stability that

might apply.

1.4 Normal distributions satisfy this property,

indeed they are the only distributions with finite variance that do so. Other

probability distributions that exhibit the stability property described above

include the Cauchy distribution and the Levy distribution.

1.5 The class of all distributions that satisfy the

above property is described by four parameters,  .

In general there are no simple closed form formulae for the probability

densities,

.

In general there are no simple closed form formulae for the probability

densities,  , and cumulative

distribution functions,

, and cumulative

distribution functions,  , applicable to these

distributional forms (exceptions are the normal, Cauchy and Levy distributions),

but there are now reliable computer algorithms for working with them.

, applicable to these

distributional forms (exceptions are the normal, Cauchy and Levy distributions),

but there are now reliable computer algorithms for working with them.

NAVIGATION LINKS

Contents | Prev | Next