Risk Measurement: Weight Overlap

[this page | pdf | references | back links]

A portfolio’s weight overlap (with a benchmark) is a

non-risk model specific measure of the extent to which holding weights in a

portfolio coincide with those in a benchmark.

Suppose that the value of the portfolio is  and the value of

an individual security

and the value of

an individual security  in the portfolio

is

in the portfolio

is  . Then its weight

in the portfolio is given by:

. Then its weight

in the portfolio is given by:

The corresponding weight in the benchmark is  say.

say.

Occasionally, the portfolio and/or benchmark can be

unfunded, in which case these weights are not well-defined. In such

circumstances there must be some positions with positive value and some with

negative value (if the portfolio is not trivially to equal zero). We might then

calculate, say, the gross portfolio value as follows, and express values by

reference to it instead.

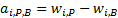

The security’s active weight is  (or more

generally

(or more

generally  if there are

several possible portfolios and benchmarks under consideration. The active

weights satisfy

if there are

several possible portfolios and benchmarks under consideration. The active

weights satisfy  .

.

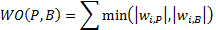

The weight overlap,  ,

then measures the proportion of the value between two portfolios that is

identical, calculated as follows (where the summation covers all securities

which appear in both

,

then measures the proportion of the value between two portfolios that is

identical, calculated as follows (where the summation covers all securities

which appear in both  and

and  ):

):

See also the MnWeightOverlap web

function.