Quantitative Return Forecasting

5. Chaotic market behaviour

[this page | pdf | references | back links]

Return to Abstract and

Contents

Next page

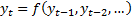

5.1 To achieve chaotic behaviour (at least

chaotic as defined mathematically) we need to drop the assumption of time

stationarity, in some shape or form. This does not mean that we need to drop

time predictability. Instead it means that the equation governing the behaviour

of the system  involves

a non-linear function

involves

a non-linear function  .

.

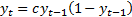

5.2 This change can create quite radically

different behaviour. Take for example the logistic map or quadratic

map:  where

where

is

constant. This mapping can also be thought of as a special case of generalised

least squares regression (but not generalised linear least squares

regression), in the sense that we can find

is

constant. This mapping can also be thought of as a special case of generalised

least squares regression (but not generalised linear least squares

regression), in the sense that we can find  by

carrying out a suitable regression analysis where one of the function is a

quadratic. In this equation

by

carrying out a suitable regression analysis where one of the function is a

quadratic. In this equation  depends

deterministically on

depends

deterministically on  and

and

is

a parameter that controls the qualitative behaviour of the system, ranging from

is

a parameter that controls the qualitative behaviour of the system, ranging from

which

generates a fixed point (

which

generates a fixed point ( )

to

)

to  where each iteration in

effect destroys one bit of information.

where each iteration in

effect destroys one bit of information.

5.3 To understand the behaviour when  , we note

that if we know the value to within e (e small) at one iteration then we will only

know the position within 2e at the next

iteration. This exponential increase in uncertainty or divergence of nearby

trajectories is what is generally understood by the term deterministic chaos.

This behaviour is quite different to that produced by traditional linear

models. Any broadband component in the power spectrum output of a traditional

linear model has to come from external noise. With non-linear systems such

output can be purely deterministically driven (and therefore in some cases

predictable). The above example also shows that the systems do not need to be

complicated to generate chaotic behaviour.

, we note

that if we know the value to within e (e small) at one iteration then we will only

know the position within 2e at the next

iteration. This exponential increase in uncertainty or divergence of nearby

trajectories is what is generally understood by the term deterministic chaos.

This behaviour is quite different to that produced by traditional linear

models. Any broadband component in the power spectrum output of a traditional

linear model has to come from external noise. With non-linear systems such

output can be purely deterministically driven (and therefore in some cases

predictable). The above example also shows that the systems do not need to be

complicated to generate chaotic behaviour.

5.4 The main advantages of such non-linear models

are that many factors influencing market behaviour can be expected to do so in

a non-linear fashion and the resultant behaviour matches observations, e.g.

markets often seem to exhibit cyclical behaviour, but with the cycles having no

set lengths, and markets are often relatively little affected by certain

drivers in some circumstances, but affected much more by the same drivers in

other circumstances.

5.5 The main disadvantages of non-linear models

are:

(a)

The mathematics is more complex;

(b)

Modelling underlying market dynamics in this way will make the modelling

process less efficient if the underlying dynamics are in fact linear in nature;

and

(c)

If markets are chaotic, then this typically places fundamental limits on

the ability of any approach to predict more than a few time steps ahead.

5.6 The last point arises because chaotic

behaviour is characterised by small disturbances being magnified over time in

an exponential fashion (as per the quadratic map described above with  ),

eventually swamping the predictive power of any model that can be built up. Of

course, in these circumstances using linear approaches may be even less

effective!

),

eventually swamping the predictive power of any model that can be built up. Of

course, in these circumstances using linear approaches may be even less

effective!

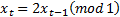

5.7 Indeed, there are purely deterministic

non-linear models that are completely impossible to use for predictive purposes

even one step ahead. Take for example a situation in which there is a hidden

state variable developing according to the following formula  but we can only observe

but we can only observe  ,

the integer nearest to

,

the integer nearest to  .

The action of the map is most easily understood by writing

.

The action of the map is most easily understood by writing  in

a binary fractional expansion, i.e.

in

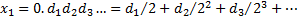

a binary fractional expansion, i.e.  .

Each iteration shifts every digit to the right, so

.

Each iteration shifts every digit to the right, so  .

Thus this system successively reveals each digit in turn. Without prior

knowledge of the seeding value, the output will appear to be completely random,

and the past values of

.

Thus this system successively reveals each digit in turn. Without prior

knowledge of the seeding value, the output will appear to be completely random,

and the past values of  available

at time

available

at time  tell us nothing at all

about values at later times!

tell us nothing at all

about values at later times!

NAVIGATION LINKS

Contents | Prev | Next