Random Matrix Theory

[this page | pdf | references | back links]

Tools

References

The risks expressed by a portfolio of assets or liabilities

depend heavily on how these assets and liabilities might ‘co-move’, i.e. move

in tandem. One way of analysing these co-movement characteristics is to

consider the covariances between the price movements of (or more precisely, the

log returns on) different assets and liabilities.

Most usually, investigators encapsulate this information

within a single structure, the covariance matrix, often estimating this matrix

empirically, using past observed covariances between the different assets and

liabilities.

But how do we tell how ‘reliable’ is this estimation

process? Suppose we have  time periods that we can

use to estimate empirically the characteristics of the covariance matrix and

time periods that we can

use to estimate empirically the characteristics of the covariance matrix and  assets

or liabilities (i.e. ‘instruments’). The correlation matrix contains

assets

or liabilities (i.e. ‘instruments’). The correlation matrix contains  distinct

entries. If

distinct

entries. If  is large relative to

is large relative to  (which it

usually is in the risk management context) then we should expect the empirical

determination of the covariance matrix to be ‘noisy’, i.e. for it to have a

material element of randomness derived from measurement ‘noise’. It should

therefore be used with caution. Such matrices can be characterised by their

eigenvectors and eigenvalues, and it is the smallest (and hence apparently

least relevant) of these that are most sensitive to this noise. But these are

precisely the ones that determine, in Markowitz theory, the precise structure

of optimal portfolios, see Laloux et

al. (1999).

(which it

usually is in the risk management context) then we should expect the empirical

determination of the covariance matrix to be ‘noisy’, i.e. for it to have a

material element of randomness derived from measurement ‘noise’. It should

therefore be used with caution. Such matrices can be characterised by their

eigenvectors and eigenvalues, and it is the smallest (and hence apparently

least relevant) of these that are most sensitive to this noise. But these are

precisely the ones that determine, in Markowitz theory, the precise structure

of optimal portfolios, see Laloux et

al. (1999).

It is thus desirable to devise ways of distinguishing

between ‘signal’ and ‘noise’, i.e. to distinguish between those eigenvalues and

eigenvectors of the covariance matrix that appear to correspond to real

characteristics exhibited by these assets and liabilities and those that are

mere artefacts of this noise.

One way of doing this is to use random matrix theory. This

theory has a long history in physics since Eugene Wigner and Freeman Dyson in

the 1950s. It aims to characterise the statistical properties of the

eigenvalues and eigenvectors of a given statistical ‘ensemble’ (i.e. the set of

random matrices exhibiting pre-chosen symmetries or other sorts of

constraints). Amongst other things, we might be interested in the average

density of eigenvalues and in the distribution of spacing between consecutively

ordered eigenvalues etc.

For example, we might compare the properties of an empirical

covariance matrix  with a ‘null hypothesis’

that the assets were, in fact, uncorrelated. Deviations from this null

hypothesis that were sufficiently unlikely might then suggest the presence of

true information.

with a ‘null hypothesis’

that the assets were, in fact, uncorrelated. Deviations from this null

hypothesis that were sufficiently unlikely might then suggest the presence of

true information.

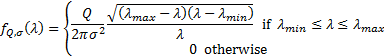

In the limit of very large matrices (i.e.  ) this density

is analytically tractable and is as follows, for covariance matrices derived

from (independent) series that have a common standard deviation,

) this density

is analytically tractable and is as follows, for covariance matrices derived

from (independent) series that have a common standard deviation,  .

Correlation matrices derived from the above null hypothesis have this property,

as they correspond to covariance matrices where each series has a standard

deviation in isolation of

.

Correlation matrices derived from the above null hypothesis have this property,

as they correspond to covariance matrices where each series has a standard

deviation in isolation of  .

.

The density, for a given  ,

is

,

is  where:

where:

In the limiting case where  is large

this has some features that get smoothed out in practice for less extreme

values of

is large

this has some features that get smoothed out in practice for less extreme

values of  , in particular the

existence of a hard upper and (if

, in particular the

existence of a hard upper and (if  ) lower limit above and

below which the density falls to zero.

) lower limit above and

below which the density falls to zero.

We may therefore adopt the following prescription for

‘denoising’ an empirically observed correlation matrix, if we can assume that

the ‘null’ hypothesis is that the instruments are independent (an assumption

that would be inappropriate if, say, we should ‘expect’ two instruments to be

correlated, e.g. the two might be listings of the same underlying asset on two

different stock exchanges, or two bonds of similar terms issued by the same

issuer), see Scherer

(2007):

(a) Work out the

empirically observed correlation matrix (which by construction has standardised

the return series so that  ).

).

(b) Identify the largest

eigenvalue and corresponding eigenvector of this matrix.

(c) If the

eigenvalue is sufficiently large, e.g. materially larger than the cut-off

derived from the above (or some more accurate determination of the null

hypothesis density applicable to the finite  case),

then deem the eigenvalue to represent true information rather than noise and

move on to step (d), otherwise stop.

case),

then deem the eigenvalue to represent true information rather than noise and

move on to step (d), otherwise stop.

(d) Record the eigenvalue

and corresponding eigenvector. Determine the contribution to each instrument’s

return series from this eigenvector. Strip out these contributions from each

individual instrument return series, calculate a new correlation matrix for

these adjusted return series and loop back to (b).

The reason we in theory need to adjust each instrument

return series in step (d) is that otherwise the ‘residual’ return series can no

longer be assumed to have a common  , so we can no longer

directly use a formula akin to that above to identify further eigenvectors that

appear to encapsulate true information rather than noise. However, if we ignore

this nicety (i.e. we adopt the null hypothesis that all residual return series,

after stripping out ‘significant eigenvectors’ are independent identically

distributed Gaussian random series with equal standard deviations) then the

computation of the cut-offs simplifies materially. This is because:

, so we can no longer

directly use a formula akin to that above to identify further eigenvectors that

appear to encapsulate true information rather than noise. However, if we ignore

this nicety (i.e. we adopt the null hypothesis that all residual return series,

after stripping out ‘significant eigenvectors’ are independent identically

distributed Gaussian random series with equal standard deviations) then the

computation of the cut-offs simplifies materially. This is because:

i.

The trace of a symmetric matrix (i.e. the sum of the leading diagonal

elements) is the same as the sum of its eigenvectors (and is therefore

invariant relative to a change in basis for the relevant vector space).

ii.

So, removing the leading eigenvector as above merely involves removing

the leading row and column, if the basis used involves the eigenvectors.

iii.

The variance of the residual series under this null hypothesis is

therefore merely the sum of the eigenvalues not yet eliminated iteratively.

iv.

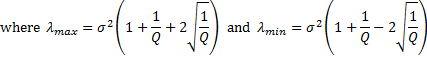

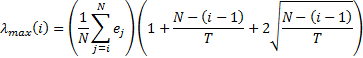

Hence, we can calculate the cutoff  for

the

for

the  ’th eigenvalue (

’th eigenvalue ( as

follows, where

as

follows, where  is

the magnitude of the

is

the magnitude of the  ’th eigenvalue (

’th eigenvalue ( :

:

Using this prescription, we would exclude any eigenvalues

and corresponding eigenvectors beyond the first one for which the eigenvalue is

not noticeably above this cutoff. The Nematrian website function MnEigenvalueSpreadsForRandomMatrices

calculates these  .

More precise tests of significance could be identified by simulating spreads of

results for random matrices.

.

More precise tests of significance could be identified by simulating spreads of

results for random matrices.

Edelman and

Rao (2005) describe how in many cases it is possible to calculate

eigenvalue densities for a wide range of transformations of random matrices,

including both deterministic and stochastic transformations. They express the

view that the usefulness of random matrix theory will through time follow that

of numerical analysis more generally, i.e. most disciplines in science and

engineering will in due course find random matrix theory a valuable tool. Its

history started in the physics of heavy atoms and multivariate statistics. It

has already found its way into wireless communications and combinatorial

mathematics and as seen above is potentially also becoming increasingly used in

the field of financial analysis and risk management.

NAVIGATION LINKS

Contents | Next