ReverseQuadraticPortfolioOptimiser

[this page | pdf | back links]

Function Description

Returns a vector containing the ‘implied alphas’ for a given

set of active positions, i.e. the return assumptions that need to be held for a

portfolio to be optimal (ignoring constraints), given active positions,

standard deviations, a correlation matrix and a trade-off factor (i.e. risk

aversion factor) that corresponds to the investor’s chosen trade-off between

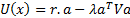

return and risk. It is assumed that the investor has a quadratic utility

function of the following form, where  is a

vector of returns,

is a

vector of returns,  is a covariance

matrix and

is a covariance

matrix and  is a

vector of active weights (i.e.

is a

vector of active weights (i.e.  , where

, where  is

a vector of portfolio weights with

is

a vector of portfolio weights with  elements

and

elements

and  is the

corresponding vector of benchmark weights):

is the

corresponding vector of benchmark weights):

Please bear in mind that if a given set of returns,  ,

is optimal in this context then so is the set of returns defined by

,

is optimal in this context then so is the set of returns defined by  for

any constant (scalar, i.e. asset class independent) values of

for

any constant (scalar, i.e. asset class independent) values of  and

and

. This

function adopts the convention that

. This

function adopts the convention that  or

equivalently

or

equivalently  , i.e.

that

, i.e.

that  and that

and that  scales

in line with the risk-return trade-off factor, i.e.

scales

in line with the risk-return trade-off factor, i.e.  .

.

Please also bear in mind that if the active position within

a live portfolio is at the limit of a constraint (e.g. for a long-only

portfolio the portfolio weight is zero, i.e. constrained by the long-only

constraint) then it is not possible to calculate accurately the implied alpha

for that position, since we do not then know (merely from the portfolio

weights) how positive or negative is the view that the manager is assigning to

that position.

NAVIGATION LINKS

Contents | Prev | Next

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Portfolio optimisation functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement