ConstrainedQuadraticPortfolioOptimiser

[this page | pdf | references | back links]

Function Description

Returns a vector  (and

three further values indicating the total asset weight, the return and the risk

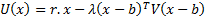

of the portfolio in that order) that maximises the following investor utility

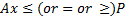

function subject to lower bound constraints of the form

(and

three further values indicating the total asset weight, the return and the risk

of the portfolio in that order) that maximises the following investor utility

function subject to lower bound constraints of the form  and

and  further

(linear) constraints of the form

further

(linear) constraints of the form  and

and  .

.

Here  are

the portfolio weights (so typically we impose at least the following constraint

are

the portfolio weights (so typically we impose at least the following constraint

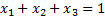

),

),  is

the benchmark (or ‘minimum risk’ portfolio),

is

the benchmark (or ‘minimum risk’ portfolio),  is a

vector of assumed returns on each asset and

is a

vector of assumed returns on each asset and  is

the covariance matrix (

is

the covariance matrix ( ,

where

,

where  is

the vector of risks on each asset class, here assumed to be characterised by

their volatilities, as this approach is merely a mean-variance one, and

is

the vector of risks on each asset class, here assumed to be characterised by

their volatilities, as this approach is merely a mean-variance one, and  their

correlation matrix).

their

correlation matrix).

Constraints are coded -1 for  , 0

for

, 0

for  and

+1 for

and

+1 for  . For

example, if

. For

example, if  ,

,  and

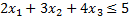

the additional linear constraints are

and

the additional linear constraints are  and

and  then:

then:

NAVIGATION LINKS

Contents | Prev | Next

Output type / Parameter details

Output type: Double()

| Parameter Name | Variable Type | Description |

| MinimumRiskPortfolio | Double() | Vector characterising the benchmark, i.e. minimum risk portfolio (n terms) |

| Lambda | Double | Risk aversion parameter |

| ForecastReturns | Double() | Vector of assumed returns from different assets (n terms) |

| ForecastRisks | Double() | Vector of assumed risks (volatilities) of different assets (n terms) |

| ForecastCorrelations | Double() | Array of assumed correlations between different assets (n x n terms) |

| LowerBounds | Double() | Vector containing the lower bounds on portfolio weights (n terms) |

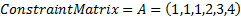

| ConstraintMatrix | Double() | Array containing the constraint coefficients applicable to the problem (m x n terms) |

| ConstraintLimits | Double() | Vector containing the constraint limits applicable to the problem (m terms) |

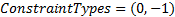

| ConstraintTypes | Integer() | Vector containing constraint types (-ve is a less than constraint, 0 is an equals constraint and +ve is a greater than) (m terms) |

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Portfolio optimisation functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement