BSCallPrice

[this page | pdf | references | back links]

Function Description

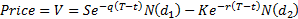

Returns the Price (i.e. value) of a European call option

assuming that the (generalised) Black-Scholes (i.e. Garman-Kohlhagen) pricing

formula applies, i.e.:

See Black-Scholes option

pricing greeks for further details of notation and (other) option greeks.

N.B. Returns the same as MnBSCall

Example values for a range of times to maturity are:

![[SmartChart]](I/MnBSCallPrice_files/image002.gif)

NAVIGATION LINKS

Contents | Prev | Next

Output type / Parameter details

Output type: Double

| Parameter Name | Variable Type | Description |

| StrikePrice | Double | Strike price of option |

| UnderlyingPrice | Double | Current price of underlying |

| InterestCts | Double | Interest rate (continously compounded) |

| DividendCts | Double | Dividend yield (continuously compounded) |

| TimeNow | Double | Time now (typically 0) |

| TimeMaturity | Double | Time at maturity |

| ImpliedVolatility | Double | Implied volatility (of price of underlying) |

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Derivative pricing functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement