Marginal Tail Value-at-Risk (Marginal

TVaR) when underlying distribution is multivariate normal

[this page | pdf | back links]

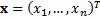

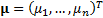

Suppose we have a set of  risk factors

which we can characterise by an

risk factors

which we can characterise by an  -dimensional

vector

-dimensional

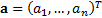

vector  . Suppose that

the (active) exposures we have to these factors are characterised by another

. Suppose that

the (active) exposures we have to these factors are characterised by another  -dimensional

vector,

-dimensional

vector,  . The aggregate

exposure is then

. The aggregate

exposure is then  .

.

The Value-at-Risk,  , of the

portfolio of exposures

, of the

portfolio of exposures  at confidence

level

at confidence

level  , is defined as

the

, is defined as

the

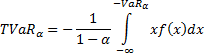

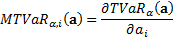

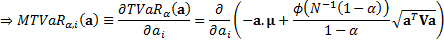

The Marginal Tail Value-at-Risk,  , is the

sensitivity of

, is the

sensitivity of  to a small change

in

to a small change

in  ’th exposure. It

is therefore:

’th exposure. It

is therefore:

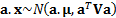

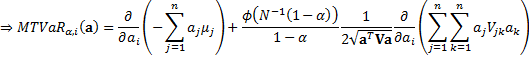

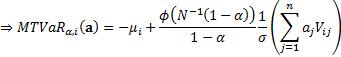

In the case where the risk factors are multivariate normally

distributed with mean  and covariance

matrix

and covariance

matrix  whose elements

are

whose elements

are  we have

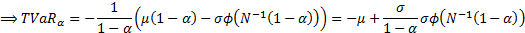

we have and hence

and hence  . Hence

. Hence  .

.

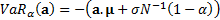

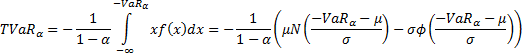

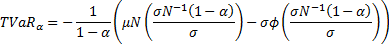

Given the formula for the truncated first moments of a normal distribution

we have:

where  ,

,  ,

,  is the

(standard) normal cumulative distribution function and

is the

(standard) normal cumulative distribution function and  is the

(standard) normal probability density function.

is the

(standard) normal probability density function.

Hence:

The second of these terms can be expressed in terms of the

correlation between  and

and  in a manner

similar to Marginal

VaR when underlying distribution is multivariate normal.

in a manner

similar to Marginal

VaR when underlying distribution is multivariate normal.

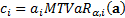

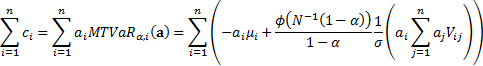

As risks arising from individual positions interact there is

no universally agreed way of subdividing the overall risk into contributions

from individual positions. However, a commonly used way is to define the Contribution

to Tail Value-at-Risk,  , of the

, of the  ’th

position,

’th

position,  to be as

follows:

to be as

follows:

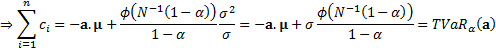

Conveniently the  then sum to the

overall VaR:

then sum to the

overall VaR:

The property that the contributions to risk add to the total

risk is a generic feature of any risk measure that is (first-order)

homogeneous, a property that Tail Value-at-Risk exhibits.