Extreme Events – Specimen Question A.4.1

[this page | pdf | references | back links]

Return to

Question and Answer Summary

You are an investor trying to understand better the

behaviour of Index B in A.2.1.

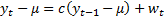

You think that it is likely to be best modelled by an AR(1) autoregressive

model along the lines of  with

random independent identically distributed normal error terms

with

random independent identically distributed normal error terms  .

.

(a) Estimate the

value of c 16 times, the first time assuming that you only have access

to the first 5 observations, the next time you only have access to the first 6

observations, etc.

Answer/Hints

(b) Do these evolving

estimates of appear to be stable? How would you test such an assertion

statistically?

Answer/Hints

NAVIGATION LINKS

Contents | Prev | Next | Chapter Questions