Calibrating probability distributions

used for risk measurement purposes to market-implied data: 2. Multi-instrument

calibration – Section Analysis

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next

Page

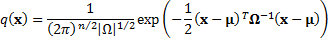

2.3 A multivariate normal distribution  with

mean

with

mean  (a

vector of random variables) and covariance matrix

(a

vector of random variables) and covariance matrix  has a

probability density function,

has a

probability density function,  as

follows, where

as

follows, where  is the

number of entries in the vector

is the

number of entries in the vector  and

and  the

number of entries in

the

number of entries in  ):

):

2.4 We note that:

(a) Any  -dimensional

multivariate normal distribution has a probability density function expressible

as

-dimensional

multivariate normal distribution has a probability density function expressible

as  where

where  is some

suitable constant and

is some

suitable constant and  is a

positive definite symmetric quadratic form (with possibly non-zero drift) in

is a

positive definite symmetric quadratic form (with possibly non-zero drift) in  different

variables, and vice versa.

different

variables, and vice versa.

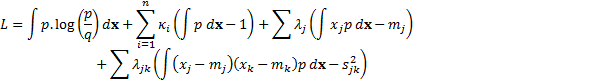

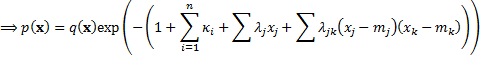

(b) Applying analytical

weighted Monte Carlo (using relative entropy) to the sort of calibration

problem referred to above will therefore return (unless the calibration problem

is ill-posed) a calibrated probability distribution which also has multivariate

normal form. This is because the problem can be restated using Lagrange multipliers

to one that involves minimising  defined

as follows, where the

defined

as follows, where the  refer

to whatever calibrations there are on the means and

refer

to whatever calibrations there are on the means and  to

those on covariance terms (in general there will be fewer than

to

those on covariance terms (in general there will be fewer than  of the

of the  ):

):

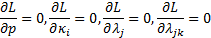

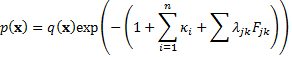

The solution to this minimisation

problem is given by the following:

subject to  (i.e.

that

(i.e.

that  is a

probability distribution) and other constraints derived directly from

calibration requirements, e.g. that

is a

probability distribution) and other constraints derived directly from

calibration requirements, e.g. that  etc.

etc.

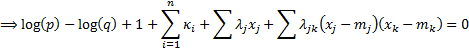

Thus if  is

expressible as

is

expressible as  as

above, then

as

above, then  will be

too, just for a different

will be

too, just for a different  .

.

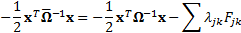

(c) Applying the

principle of no arbitrage we may therefore expect  to have

zero mean (more precisely for each element of

to have

zero mean (more precisely for each element of  to be

the same, which without loss of generality we may take as zero if we are

focusing on relative returns) and therefore to have the form:

to be

the same, which without loss of generality we may take as zero if we are

focusing on relative returns) and therefore to have the form:

where the  are

symmetric zero-drift quadratic forms (

are

symmetric zero-drift quadratic forms ( , say)

corresponding to each of the implied volatilities/implied correlations to which

we wish to calibrate.

, say)

corresponding to each of the implied volatilities/implied correlations to which

we wish to calibrate.

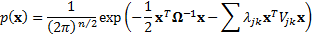

(d) The calibrated

distribution will therefore be multivariate normal with zero mean and

probability distribution as follows, for suitably chosen  that

reproduce for the calibrations the relevant market implied variances or

covariances (where

that

reproduce for the calibrations the relevant market implied variances or

covariances (where  is some

constant the value of which ensures that

is some

constant the value of which ensures that  ):

):

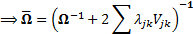

(e) Thus the calibrated

probability distribution will be characterised by a covariance matrix  as

follows:

as

follows:

NAVIGATION LINKS

Contents | Prev | Next