Solvency II Standard Formula SCR: Market

Risk Module – ConcentrationRisk Sub-module

[this page | pdf | references | back links]

The computation for this sub-module is specified in DA

Articles 182 – 187 and loosely speaking involves the following approach:

(a) Calculate  = exposure at

default to counterparty

= exposure at

default to counterparty

(b) Calculate  = amount of total

assets to which concentration risk sub-module applies

= amount of total

assets to which concentration risk sub-module applies

(c) Determine  = credit quality

step applied to counterparty

= credit quality

step applied to counterparty

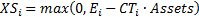

(d) Calculate ‘excess’

exposure to that counterparty,  , using the

following formula, where the specified concentration threshold,

, using the

following formula, where the specified concentration threshold,  , varies according

to the credit quality step:

, varies according

to the credit quality step:

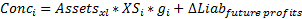

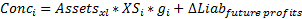

(e) Calculate risk

concentration charge, per name as follows, where  is rating

dependent as below:

is rating

dependent as below:

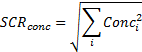

(f) Calculate

the overall capital requirement as:

Some overrides apply to specified types of assets, see DA

Article 187.

The approach went through a significant number of iterations

as Solvency II developed, much like the spread risk

sub-module.

For example in CEIOPS (2010)

the approach proposed involved:

Here  and

and  were:

were:

|

Rating

|

CT

|

g*

|

|

AAA, AA

|

3%

|

0.12

|

|

A

|

3%

|

0.21

|

|

BBB

|

1.5%

|

0.27

|

|

BB or lower, or unrated

|

1.5%

|

0.73

|

Similar but not identical parameters were used for QIS4. The

ones finally adopted in the Delegated

Act are similar to those shown above, except that they refer to credit

quality steps rather than credit ratings.

In the above,  (called

(called  in CP47 Final

Advice) was the impact on the undertaking’s liabilities (for policies where the

policyholders bear the investment risk) of a change in the value of the assets

of the issuer attracting a concentration risk charge by

in CP47 Final

Advice) was the impact on the undertaking’s liabilities (for policies where the

policyholders bear the investment risk) of a change in the value of the assets

of the issuer attracting a concentration risk charge by  (subject to a minimum

of nil).

(subject to a minimum

of nil).

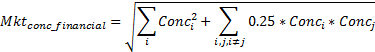

Aggregate exposures across different names were then to be

combined assuming a correlation of 0.25 between names, so:

However, by the time the Delegated

Act was adopted, the correlation between (unrelated) names had in effect

been reduced to zero.

Version dated 7 December 2015

NAVIGATION LINKS

Contents | Prev | Next