Solvency II Standard Formula SCR:

Counterparty Default Risk Module – Type 2 Risks

[this page | pdf | references | back links]

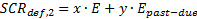

The final Solvency II Delegated

Act subdivides counterparty exposures into two types. Type 2 aims to cover

exposures primarily of the sort which are usually diversified and where the

counterparty is likely to be unrated (e.g. receivables from intermediaries or

policyholder debtors). It involves a formula along the following lines:

where:

=

risk factor for type 2 exposures

=

risk factor for type 2 exposures

=

sum of the values of type 2 exposures, except for receivables from

intermediaries which have been due for more than

=

sum of the values of type 2 exposures, except for receivables from

intermediaries which have been due for more than  months

months

=

risk factor for past-due receivables from intermediaries

=

risk factor for past-due receivables from intermediaries

= sum of values

of receivables from intermediaries which have been due for more than

= sum of values

of receivables from intermediaries which have been due for more than  months

months

As with the Type 1

exposures, the impact of possible recoveries should be taken into account when

assessing exposures, see loss-given-default

adjustments.

Version dated 7 December 2015

NAVIGATION LINKS

Contents | Prev | Next