Performance Measurement Theory

3. Performance attribution

[this page | pdf | references | back links]

Return to

Abstract and Contents

Next

page

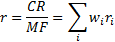

3.1 Portfolios will typically contain several

sectors, in which case, given the same linear approximation as used above, the

total fund and benchmark returns,  and

and  will

be as follows,

will

be as follows,  = mean fund

weighting for sector

= mean fund

weighting for sector  ,

,  = return for

that individual sector etc,

= return for

that individual sector etc,  = benchmark

weighting for sector

= benchmark

weighting for sector  and

and  = return

on benchmark for sector

= return

on benchmark for sector  :

:

where  and

and

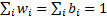

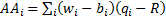

3.2 Their difference is therefore as follows (since

):

):

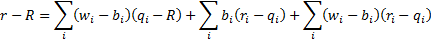

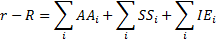

3.3 We can rewrite the relative performance as

follows:

where  ,

,  and

and  .

.

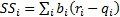

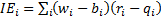

3.4 The  are the

contributions from ‘asset allocation’, the

are the

contributions from ‘asset allocation’, the  are the

contributions from ‘stock selection’ and the

are the

contributions from ‘stock selection’ and the  are the

contributions from an ‘interaction effect’. The interaction effect is the

cross-product term that arises from the fact that the value added by stock

selection is based on the amount of assets involved. Typically, the interaction

effect is added into stock selection if you are a ‘top-down’ manager and into

asset allocation if you are a ‘bottom-up’ manager.

are the

contributions from an ‘interaction effect’. The interaction effect is the

cross-product term that arises from the fact that the value added by stock

selection is based on the amount of assets involved. Typically, the interaction

effect is added into stock selection if you are a ‘top-down’ manager and into

asset allocation if you are a ‘bottom-up’ manager.

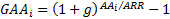

3.5 The above analysis concentrates on additive

attribution. To make the contributions from asset allocation and stock

selection chain-link they can be restated in a geometric fashion as follows:  and

and  (and a

corresponding

(and a

corresponding  if the

interaction term is kept separate) where

if the

interaction term is kept separate) where  =

geometric relative return at total assets level,

=

geometric relative return at total assets level,  =

additive relative return at total assets level and

=

additive relative return at total assets level and  and

and  are the

additive asset allocation contribution and additive stock selection

contribution from sector

are the

additive asset allocation contribution and additive stock selection

contribution from sector  . Or, one can use

natural logarithms using, say,

. Or, one can use

natural logarithms using, say,  so that

so that  . The total

logarithmic contribution to return from a particular source over several

periods can then be found merely by adding these terms together over.

. The total

logarithmic contribution to return from a particular source over several

periods can then be found merely by adding these terms together over.

3.6 Decomposing returns by ‘factors’ is

conceptually quite similar. However, we also need:

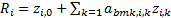

(a) For both fund

and benchmark, the average exposure to each factor involved in the

decomposition, say  and

and

(b) For the benchmark

only, the return a sector would deliver with zero factor exposure,  and the extra

return for a unit exposure to each individual factor (for each sector), say:

and the extra

return for a unit exposure to each individual factor (for each sector), say:  so that

so that  .

.

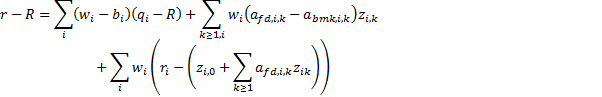

3.7 The relative return can then be decomposed

into:

3.8 The first term is the contribution from asset

allocation, the second the component of the stock selection explained by the

various factors, and the third the residual component of stock selection which

is unexplained by the various factors. The second term would normally be shown

decomposed by both sector and factor. The sector analysis described above is a

special case with  and with more

than one value for

and with more

than one value for  . We would

ideally want to build up the

. We would

ideally want to build up the  by

calculating the corresponding factor exposures by line of stock and then

aggregating to the sector level. We might also do this for the benchmark as

well or we might use a separate summarised data source.

by

calculating the corresponding factor exposures by line of stock and then

aggregating to the sector level. We might also do this for the benchmark as

well or we might use a separate summarised data source.

3.9 Currency effects can be accommodated within

this framework by including as separate ‘sectors’ any currency hedges away from

the fund’s base position. If the base position is a hedged benchmark then these

would be reverse hedges to reintroduce exposure to that currency. Performance

measurers have developed lots of other ways of taking currency into account,

although many only seem particularly relevant for certain ways in which

currency decisions might be taken vis-à-vis sector or security selection decisions.

NAVIGATION LINKS

Contents | Prev | Next