PlotQuadraticEfficientPortfolios

[this page | pdf | references | back links]

Function Description

Returns a plot of the asset mixes underlying a (constrained

quadratic) efficient frontier. More precisely, returns a string which is the

(temporary) code for a SmartChart

that plots such information.

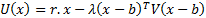

These asset mixes are the portfolios that optimise the

following utility (for a variety of risk-reward trade-off factors,  ),

where

),

where  is a vector

of portfolio weights,

is a vector

of portfolio weights,  is a vector

of assumed returns on each asset and

is a vector

of assumed returns on each asset and  is the

covariance matrix (

is the

covariance matrix ( , where

, where  is

the vector of risks on each asset class, here assumed to be characterised by

their volatilities, as this approach is merely a mean-variance one, and

is

the vector of risks on each asset class, here assumed to be characterised by

their volatilities, as this approach is merely a mean-variance one, and  their

correlation matrix):

their

correlation matrix):

Inputs are as per MnConstrainedQuadraticPortfolioOptimiser

(which is the web function used to calculate the underlying portfolios

contributing to the efficient frontier) except that:

(a) An array of  ’s

is supplied rather than a single value

’s

is supplied rather than a single value

(a) The user can

select a Title for the chart (using ChartTitle)

(b) An additional ChartFormat

parameter is available to specify how the chart should be formatted. For

further details on how to use the ChartFormat parameter to format a

chart see using the

ChartFormat parameter.

NAVIGATION LINKS

Contents | Prev | Next

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Charting functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement