Measuring the Average Correlation of

Stocks in a Universe

[this page | pdf | references | back links]

1. The problem

Investors are interested in the average correlation between

stocks because it:

(a) has a potential

impact on their ability to add alpha; and

(b) affects the level of

portfolio risk they might be running.

How might we best estimate and measure ‘cross-stock’

correlation? By ‘best’ we mean a suitable combination involving both (i) ease

of computation and (ii) relevance to portfolio construction/risk analysis.

2. The problem

Tierens and

Anadu (2004) propose three alternative methods for estimating average stock

correlations:

(a) Calculate a full correlation matrix, weighting its

elements in line with the weight of the corresponding stocks in the

portfolio/index, and excluding correlations between the stock and itself (i.e.

the diagonal elements of the correlation matrix)

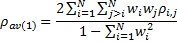

This involves the following formula, where  is the full

correlation matrix, weighting in line with product of the weights in the

portfolio of the stocks to which the relevant correlation coefficient relates,

but excluding diagonal elements, i.e.:

is the full

correlation matrix, weighting in line with product of the weights in the

portfolio of the stocks to which the relevant correlation coefficient relates,

but excluding diagonal elements, i.e.:

Tierens and Anadu argue that this approach yields the most

accurate measure of cross-stock correlation, because it uses all the different

pair-wise correlations. However, it comes at the expense of computational

complexity, as we require  correlation

coefficients as well as

correlation

coefficients as well as  portfolio

weights, i.e. a total of

portfolio

weights, i.e. a total of  inputs. Also,

Tierens and Anadu argued that it would in practice be impossible to apply this

methodology to compute average market-implied correlations.

inputs. Also,

Tierens and Anadu argued that it would in practice be impossible to apply this

methodology to compute average market-implied correlations.

(b) Proxy average correlation using only individual

stock volatilities and that of the portfolio/index as a whole

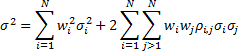

We start from the definition of (variance-related) portfolio

risk as:

where  is the

volatility of the total return of stock

is the

volatility of the total return of stock  and

and  is

the volatility of the total return of the portfolio.

is

the volatility of the total return of the portfolio.

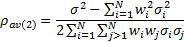

If we replace  by an average

we can back out an implicit calculation for the average cross-sectional

correlation as follows:

by an average

we can back out an implicit calculation for the average cross-sectional

correlation as follows:

This avoids calculating inputs that require pair-wise

comparisons; the only inputs we need are single stock volatilities, single

stock weights and the volatility of the overall portfolio. The total number of

inputs therefore drops to  . Moreover, it

is more practical to apply this methodology to infer the level of average

market-implied correlation in the options market, by replacing realised stock

and portfolio volatilities by implied stock and portfolio (index) volatilities.

. Moreover, it

is more practical to apply this methodology to infer the level of average

market-implied correlation in the options market, by replacing realised stock

and portfolio volatilities by implied stock and portfolio (index) volatilities.

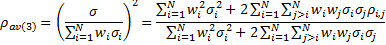

(c) Refine (b) by reference to the ratio of index to

average stock volatility

The third method follows the spirit of method (b) and

captures the intuition that the volatility of a portfolio is typically lower

than the weighted average volatility of the underlying constituents because

stocks are less than perfectly correlated. We might therefore, as a rule of

thumb, define:

3. Comments

3.1 Tierens and

Anadu (2004) compared method (b) and method (c) showed that method (b)

removes stock variance (as opposed to covariance) whilst method (c) doesn’t but

is otherwise similar to (b). A corollary is that as  (and

each

(and

each  ) these two

proxy methods will converge.

) these two

proxy methods will converge.

3.2 If we have stocks with identical volatilities

then methods (a) and (b) produce the same answer, but method (c) produces a

higher answer. However, for stocks with non-identical volatilities then there

may be a bias in method (b) too; each pair-wise correlation is weighted by how

the product of the volatilities for each of the two stocks in the pair compares

to the sum of the volatility products across all pairs of stocks. However, Tierens and

Anadu (2004) argue that biases introduced by the simpler methods (b) and

(c) appear to be modest in practice for well diversified portfolios/indices.

3.3 This discussion is potentially relevant to the

topic of calibrating assumed multivariate normal prior distributions to market

implied data, both for instrument pricing of more complicated derivatives and

for market implied risk management purposes, see Calibrating

Priors to Market Implied Data. However, we find that usually we want to

calibrate covariances rather than correlations, since it is the

former that drive portfolio risk directly not the latter. It is thus worth

bearing in mind that using as an input to these calibrations an average stock correlation

may not be ideal for calibration purposes, except for instruments more directly

linked to correlation than to covariance.

References

Tierens,

I. and Anadu, M. (2004). Goldman Sachs Quantitative Insights Research Note,

13 April 2004. Goldman Sachs