Enterprise Risk Management Formula Book

13. Miscellaneous

[this page | pdf | back links]

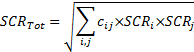

13.1 Combining solvency capital requirements using

correlations

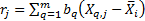

A correlation based combination of individual solvency

capital requirements involves a formula along the lines of:

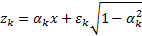

13.2 Credit risk modelling

A single factor credit portfolio model generally assumes  where

where  is

the (standardised) factor return/movement,

is

the (standardised) factor return/movement,  is the exposure of

the

is the exposure of

the  ’th obligor to that

factor and

’th obligor to that

factor and  is the

idiosyncratic noise term for that obligor.

is the

idiosyncratic noise term for that obligor.

If  is the same for

all instruments (e.g. all are assumed to have same correlation with market plus

only an idiosyncratic term) then

is the same for

all instruments (e.g. all are assumed to have same correlation with market plus

only an idiosyncratic term) then  . In such

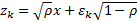

circumstances and if all obligors have the same probability of default

. In such

circumstances and if all obligors have the same probability of default  say

then probability

say

then probability  that

that  out

of

out

of  default is:

default is:

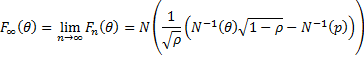

If  is the cumulative

probability that the percentage loss on the portfolio does not exceed

is the cumulative

probability that the percentage loss on the portfolio does not exceed  then

in the well diversified limit (Vasicek’s loss distribution):

then

in the well diversified limit (Vasicek’s loss distribution):

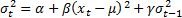

13.3 GARCH models

Risk models may cater for heteroscedasticity by including

GARCH features, e.g. the model might involve formulae along the lines of (in

practice  will slowly evolve

as additional data is received):

will slowly evolve

as additional data is received):

where for, say, a GARCH(1,1) model

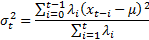

RiskMetrics typically uses the following approach for

estimating  (often using

(often using  for some suitably

chosen decay factor

for some suitably

chosen decay factor  ) which can be

viewed as an example of a GARCH approach and/or using weighted moments.

) which can be

viewed as an example of a GARCH approach and/or using weighted moments.

13.4 Linear algebra and principal components

Suppose we have  data series (e.g.

returns) each with

data series (e.g.

returns) each with  observations,

observations,  , that are

coincident in time across the different data series. Suppose the

, that are

coincident in time across the different data series. Suppose the  covariance

matrix of the (empirical) covariances between the different series is

covariance

matrix of the (empirical) covariances between the different series is  . The eigenvalues

and eigenvectors of

. The eigenvalues

and eigenvectors of  are the values of

are the values of  (scalar)

and associated

(scalar)

and associated  (vector) for which

(vector) for which

. An

. An  matrix

has

matrix

has  (not necessarily

distinct) eigenvalues and associated eigenvectors. Eigenvectors associated with

distinct eigenvalues are orthogonal, i.e.

(not necessarily

distinct) eigenvalues and associated eigenvectors. Eigenvectors associated with

distinct eigenvalues are orthogonal, i.e.  for

for  .

Orthonormal eigenvectors have

.

Orthonormal eigenvectors have  and

and  for

for  .

For any distinct eigenvalue the associated orthonormal eigenvector is unique up

to a change of sign. If

.

For any distinct eigenvalue the associated orthonormal eigenvector is unique up

to a change of sign. If  eigenvalues all

take the same value then it is possible to find

eigenvalues all

take the same value then it is possible to find  orthogonal

eigenvectors corresponding to all of these eigenvalues. For empirical

covariance matrices,

orthogonal

eigenvectors corresponding to all of these eigenvalues. For empirical

covariance matrices,  is symmetric

non-negative definite (and positive definite if no two data series are

perfectly correlated) and all of its

is symmetric

non-negative definite (and positive definite if no two data series are

perfectly correlated) and all of its  eigenvalues,

eigenvalues,  , are greater than

or equal to zero. One way of telling if a matrix is positive definite is to

test whether it is possible to apply a Cholesky decomposition to it.

, are greater than

or equal to zero. One way of telling if a matrix is positive definite is to

test whether it is possible to apply a Cholesky decomposition to it.

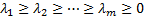

The eigenvalues and associated eigenvectors of an empirical

covariance matrix may be sorted so that  . The first

principal component is the mixture of the underlying (de-meaned) series,

i.e. the

. The first

principal component is the mixture of the underlying (de-meaned) series,

i.e. the  , that corresponds

to the orthonormal eigenvector,

, that corresponds

to the orthonormal eigenvector,  , corresponding to

the largest eigenvalue of

, corresponding to

the largest eigenvalue of  . This choice of

. This choice of  maximises

maximises  subject to

subject to  , Other (lesser) principal components

correspond to orthonormal eigenvectors corresponding to smaller eigenvalues.

, Other (lesser) principal components

correspond to orthonormal eigenvectors corresponding to smaller eigenvalues.

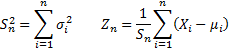

13.5 Central limit theorem

Suppose we have a series of independent random variables  each with finite

(bounded) expected value

each with finite

(bounded) expected value  and finite

(bounded) standard deviation

and finite

(bounded) standard deviation  . Suppose

. Suppose  and

and  are defined as:

are defined as:

Then subject to certain regularity conditions the

distribution of  tends

asymptotically to

tends

asymptotically to  (it is exactly

(it is exactly  if each of the

if each of the  is normally

distributed).

is normally

distributed).

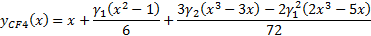

13.6 Cornish-Fisher asymptotic expansion

The (4th moment) Cornish-Fisher

asymptotic expansion approximates a standardised QQ-plot via the following

function:

where  and

and  are the skew and

excess kurtosis of the data.

are the skew and

excess kurtosis of the data.

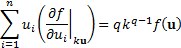

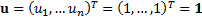

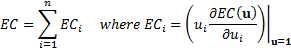

13.7 Euler capital allocation principle

A function  where

where  is said to be

homogenous of order

is said to be

homogenous of order  if:

if:

Suppose we have  business lines,

the outcome (loss) to each business line given its current size is

business lines,

the outcome (loss) to each business line given its current size is  (a random

variable) so the total loss is

(a random

variable) so the total loss is  where for the

current business portfolio the business line allocation is

where for the

current business portfolio the business line allocation is  . Suppose the risk

measure used to determine economic capital is

. Suppose the risk

measure used to determine economic capital is  and that it is

homogeneous of order 1, i.e.

and that it is

homogeneous of order 1, i.e.  . Then the Euler

capital allocation principle (and, in effect, the Marginal VaR or Internal beta

approach to setting RAROC rates) allocates total economic capital,

. Then the Euler

capital allocation principle (and, in effect, the Marginal VaR or Internal beta

approach to setting RAROC rates) allocates total economic capital,  (technically

a function of the business portfolio allocation,

(technically

a function of the business portfolio allocation,  ) into capital for

each business line,

) into capital for

each business line,  , as follows:

, as follows:

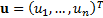

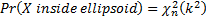

13.8 Equiprobable outcomes for a multivariate normal

distribution

If  where

where  then equiprobable

scenarios (i.e. contours where

then equiprobable

scenarios (i.e. contours where  is constant) are

ellipsoids defined by

is constant) are

ellipsoids defined by  for some constant

value of

for some constant

value of  . The probability

that

. The probability

that  lies within this

ellipsoid is given by a chi-squared with

lies within this

ellipsoid is given by a chi-squared with  degrees of

freedom:

degrees of

freedom:

13.9 RAROC, EIC, SHV and SVA

Risk adjusted return on capital (RAROC) is usually defined

as follows, where  = Adjusted

earnings = Earnings – Interest cost – expected loss – funding

cost – other costs and

= Adjusted

earnings = Earnings – Interest cost – expected loss – funding

cost – other costs and  = capital:

= capital:

Economic income created (EIC) is usually defined as where  =

per unit cost of equity (i.e. hurdle rate):

=

per unit cost of equity (i.e. hurdle rate):

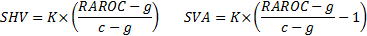

Shareholder value (SHV) and shareholder value added (SVA)

(also known as economic value added, EVA) translate current period return

contribution to overall economic value. Given suitable assumptions about future

growth prospects for a business,  , these are:

, these are:

NAVIGATION LINKS

Contents | Prev | Next