Formulae for prices and Greeks for

European (vanilla) calls in a Black-Scholes world

[this page | pdf | references | back links]

See Black Scholes Greeks

for notation.

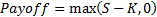

Payoff, see MnBSCallPayoff

Price (value), see MnBSCallPrice

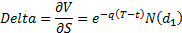

Delta (sensitivity to underlying), see MnBSCallDelta

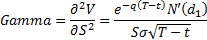

Gamma (sensitivity of delta to underlying), see MnBSCallGamma

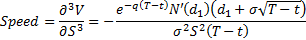

Speed (sensitivity of gamma to underlying), see MnBSCallSpeed

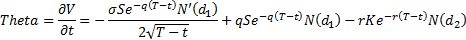

Theta (sensitivity to time), see MnBSCallTheta

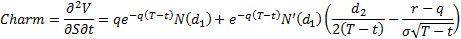

Charm (sensitivity of delta to time), see MnBSCallCharm

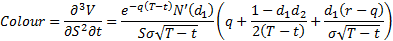

Colour (sensitivity of gamma to time), see MnBSCallColour

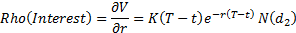

Rho(interest) (sensitivity to interest rate), see MnBSCallRhoInterest

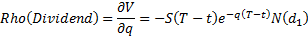

Rho(dividend) (sensitivity to dividend yield), see MnBSCallRhoDividend

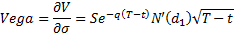

Vega (sensitivity to volatility), see MnBSCallVega}*

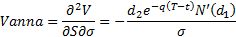

Vanna (sensitivity of delta to volatility), see MnBSCallVanna*

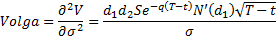

Volga (or Vomma) (sensitivity of vega to volatility), see MnBSCallVolga*

* Greeks like vega, vanna and Volga/vomma that involve

partial differentials with respect to  are in some

sense ‘invalid’ in the context of Black-Scholes, since in its derivation we

assume that

are in some

sense ‘invalid’ in the context of Black-Scholes, since in its derivation we

assume that  is constant. We

might interpret them as applying to a model in which

is constant. We

might interpret them as applying to a model in which  was

slightly variable but otherwise was close to constant for all

was

slightly variable but otherwise was close to constant for all  ,

,

etc.. Vega, for

example, would then measure the sensitivity to changes in the mean level of

etc.. Vega, for

example, would then measure the sensitivity to changes in the mean level of  .

For some types of derivatives, e.g. binary puts and calls, it can be difficult

to interpret how these particular sensitivities should be understood.

.

For some types of derivatives, e.g. binary puts and calls, it can be difficult

to interpret how these particular sensitivities should be understood.